Investing in biotechnology attracts investors due to its potential of higher than average returns. A company that is expected to successfully complete the Food and Drug Administration's drug approval process can significantly outperform the market. However, it should be noted that the value of these stocks can be cut in half just as quickly.

Where there is reward, there is risk. However, time is one of the best risk mitigation strategies when it comes to investing. So consider the following when thinking about long-term investments in biotech.

Why Invest in the Biotechnology Sector

The healthcare industry has been going though a lot of change lately due to the varying political landscape. Despite all of this uncertainty, it should be obvious that the healthcare industry is not going away anytime soon. The demand for health care is supported not only by our instinctual drive for survival, but also economically though government programs (i.e. your tax dollars).

When investing in this space, the difference between biotech and pharmaceutical companies should be understood. Pharmaceutical companies manufacture and distribute chemically engineered medications strictly for healthcare purposes, think synthetic chemical compounds. This is in contrast to biotech companies which develop medications and other solutions (i.e. pest resistant foods) on a biological basis.

Biotechnology companies spend more on research and development than pharmaceutical firms, thus are provided with patents with a longer protection period. Additionally, biotech companies develop solutions that reach beyond medications, thus they have a wider applicability across industries.

As stated above, the demand for healthcare will not fade anytime soon and there is little doubt that the government will continue to subsidize it. This makes a case for the prospects of this industry as a whole. Additionally, our society has begun to shift away from generally accepting chemical laden products. This can be seen through less use of certain plastics, foods and medications. Thus, biotechnology will continue to take an important role in shaping the world of tomorrow.

Seek Broad Diversification in Biotech Investments

It should be understood that biotechnology stocks can be some of the most volatile. Volatility, being a double-edged sword, provides exciting opportunity for traders but heartburn for the long-term investor. To reduce volatility, while still participating in the potential upside of this industry, it is recommended to remain well diversified.

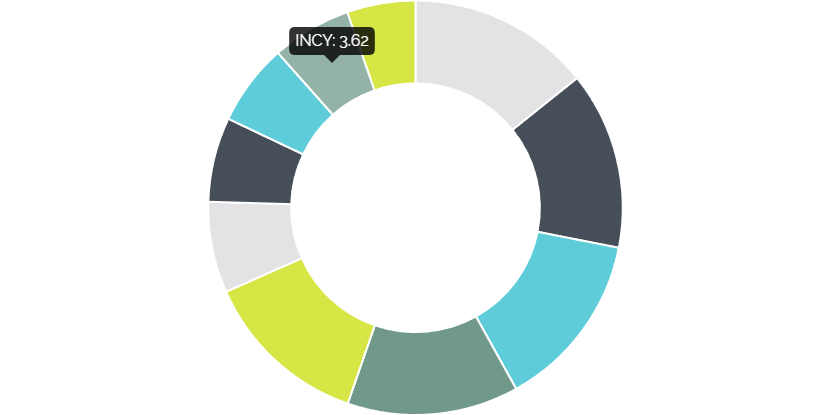

One of the easiest ways to ensure your biotech position is diversified is to invest in a Exchange Traded Fund (ETF) such as iShares NASDAQ Biotechnology Index (IBB). This ETF is comprised of shares of 162 biotechnology companies. While this sector is speculative, IBB is comprised of roughly 63% large cap stocks. While the remaining 37% is comprised of mid, small and micro cap equities.

IBB's Top 10 Holdings

Match Portfolio Holdings with Future Expenses

Investing and portfolio management, being a significant element within the financial planning process, gets plenty of attention from academic circles. A few years ago I came across the theory that claimed "a proportion of a long-term retirement portfolio should match the expenses in which it is expected to resource in the future".

This theory seeks to match the inflation rate of an investor's future retirement expenses with the growth rate of the companies that operate in that sector. Simply stated, if you will expect to have out of pocket healthcare expenses during retirement, then a portion of your retirement portfolio should include healthcare stocks.

Organizing your portfolio in this manner is intended to ensure that the growth of your investments does not lag (or fall behind) the increasing cost of the products and services you will need in the future. Investing in biotech can satisfy the parameters of this financial planning theory as its reasonable to assume that the medications in research and development today will be prescribed to patients in the near and distant future.

Timing Your Biotech Investments

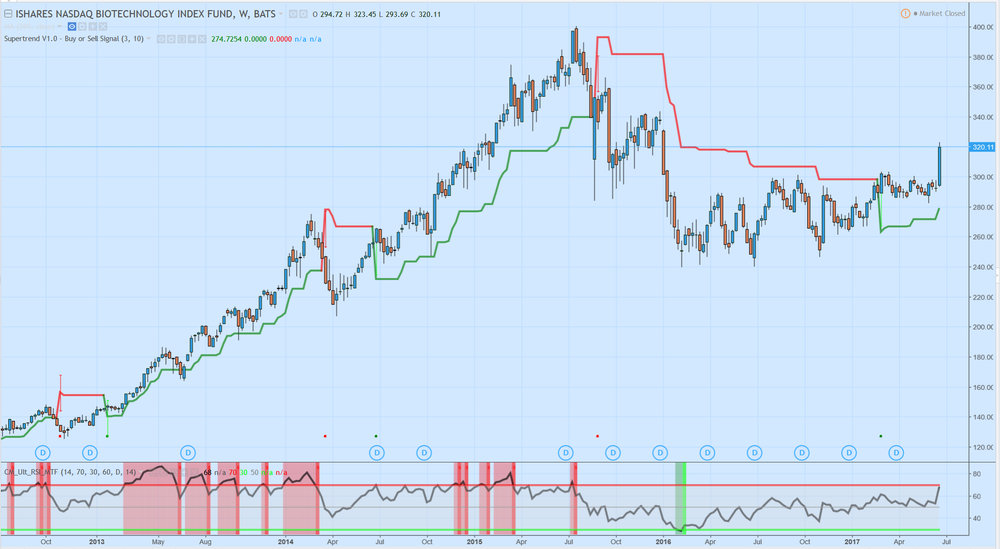

The biotechnology sector, as evidenced by ETF's such as IBB, experienced significant growth between 2012 and 2015. This growth was due to a variety of industry and political circumstances. However, these stocks were hit hard halfway through 2015 and have been inching up since a bottom was formed in early 2016. All being said, this large correction (~37%) was needed and should be considered "healthy".

As I write this, the sector is having one of its best week's in a few years. For long-term investors this may signal the start of a great opportunity. I usually like to invest in stocks (or ETFs) that have experienced a 20% or greater correction and show signs of upward momentum. Taking a look at that chart, it seems to fit my criteria pretty well.