Sometimes you win, sometimes you lose. The most important part of stock trading is that you remember that your losers should be smaller than your winners. If you can learn to manage your trades like this, your win to loss ratio can be less than 1:1 (meaning you can have more losers than winners overall). Over the years I’ve learned a few different ways to manage trades in this manner.

Below you’ll find a breakdown of a pair of recent trades that illustrate my point. Within the past week or so, I opened two positions. Both Palo Alto Networks (PANW) and Starbucks (SBUX) had solid fundamentals and technicals at the time. Unless I am looking for an oversold contrarian trade (such as oil right now), I mainly have my eye on growth stocks. Both of the companies passed my fundamental tests, thus my next step is to look at the charts to determine a good entry point.

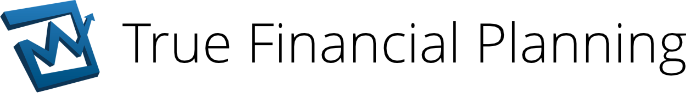

At the time PANW had pulled back roughly 15% from its all time high in July. I like stocks that are off their highs since this increases the probability of the price action going my way. Additionally the stock had formed a bullish pennant which gave me the “green light” to put some capital to work.

Over the next few days, PANW shot straight up (well, pretty much). So in order to ensure that this winning trade didn’t turn into a loser, I placed a stop order at the top of the gap to lock in my gains. At the time of this writing, the trade is up 18%. Keep in mind that most trades do not go in your favor this far and fast. An earnings release and reported projected growth rates had a lot to do with the price action shortly after I initiated the position. This one is still open.

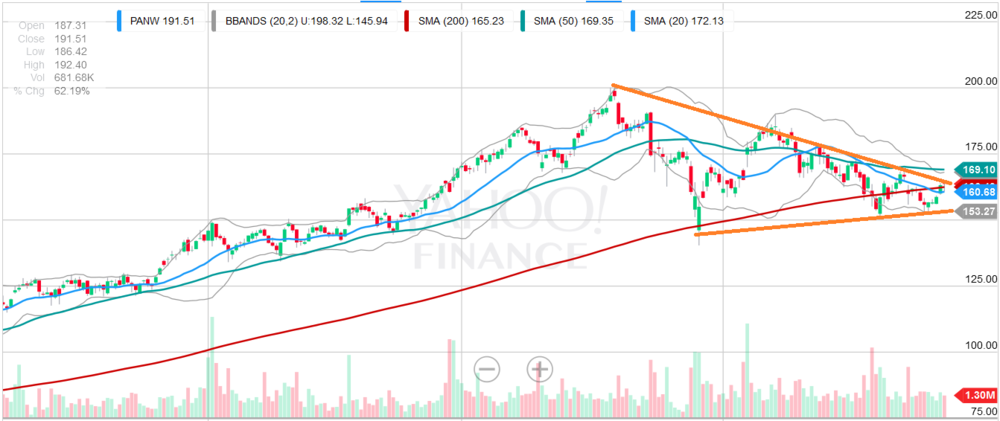

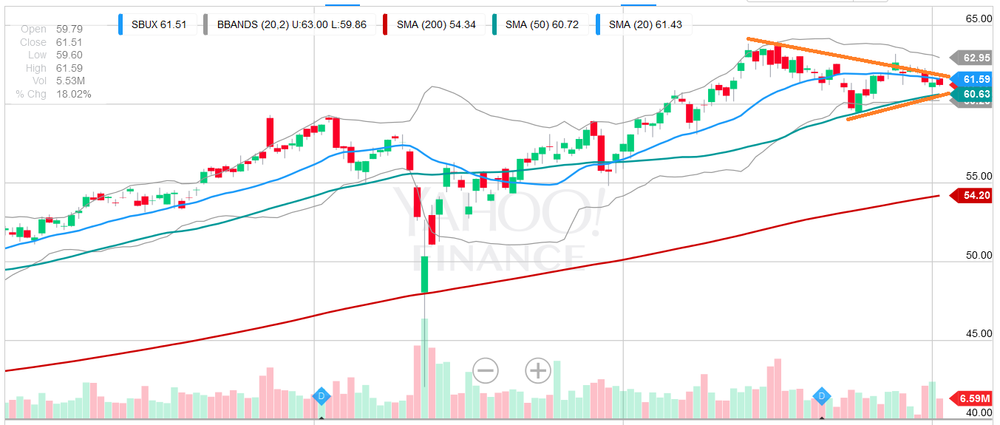

The next trade didn’t go so well, it actually was a quick loser. I bought SBUX for most of the same reasons I bought PANW. The only difference being Starbucks growth potential isn’t as rapid as Palo Alto Networks. SBUX was off its highs and was consolidating in a ascending pennant. Additionally, SBUX had just bounced off the 50 day moving average twice before. Due to this price action and decent fundamentals, I expected price action similar to PANW.

Once the buy order was filled, I placed a stop order to sell the stock if the price sunk a dollar below the 50 day moving average. I figured that if price fell below that level, the chart and trade was broken and I didn't want to be in it. Well the very next day, SBUX sold off (with the rest of the market) and my stop order was triggered and filled. Over all I lost 2.3% on the trade; easily recoverable.

I hope this example illustrates the importance of trade and risk management. Before you get into a trade, know at what point the trade is broken and determine how much you are willing to lose if you’re wrong. Keeping your trade losses as small as possible will keep you in the market. If you spend more time trying not to lose money, the rest is will take care of itself.